Recently, Wood Mackenzie’s global PV research team released its latest research report – “Global PV Market Outlook: Q1 2023″.

Wood Mackenzie expects global PV capacity additions to reach a record high of more than 250 GWdc in 2023, an increase of 25% year-over-year.

The report notes that China will continue to consolidate its global leadership position and that in 2023, China will add more than 110 GWdc of new PV capacity, accounting for 40% of the global total. During the “14th Five-Year Plan” period, the annual domestic incremental capacity will remain above 100GWdc, and China’s PV industry will enter the 100 GW era.

Among them, in the supply chain capacity expansion, module prices are back down and the first batch of wind power PV base will soon be an all-grid-connected trend, 2023 centralized PV installed capacity is expected to grow significantly and is expected to exceed 52GWdc.

In addition, the whole county to promote the policy will continue to help the development of distributed PV. However, behind the surge in installed new energy capacity, in Shandong, Hebei, and other large installed provinces, the risk of wind abandonment and power limitation and auxiliary service costs, and other issues gradually revealed, or will slow down investment in the distribution sector, the installed distributed capacity in 2023 or will fall back.

International markets, policy, and regulatory support will become the biggest thrust for the development of the global photovoltaic market: the U.S. “Inflation Reduction Act” (IRA) will invest $ 369 billion in the clean energy sector.

The EU REPowerEU bill sets a target of 750GWdc of installed PV capacity by 2030; Germany plans to introduce tax credits for PV, wind, and grid investments. But with several EU member states planning to deploy renewables on a large scale by 2030, many mature European markets are also facing increasing grid bottlenecks, particularly in the Netherlands.

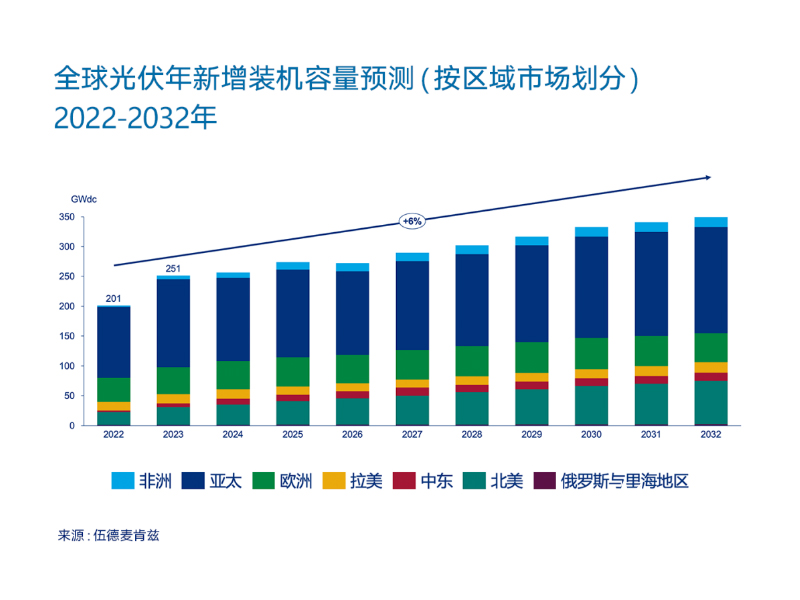

Based on the above, Wood Mackenzie expects global grid-connected PV installations to grow at an average annual rate of 6% from 2022-2032. By 2028, North America will have a larger share of global annual PV capacity additions than Europe.

In the Latin American market, Chile’s grid construction is lagging behind the country’s renewable energy development, making it difficult for the country’s power system to consume renewable energy, triggering renewable energy tariffs that are less than expected. Chile’s National Energy Commission has launched a new round of tenders for transmission projects to address this issue and has made proposals to improve the short-term energy market. Major markets in Latin America (such as Brazil) will continue to face similar challenges.

Post time: Apr-21-2023