Key Trends Driving Solar in 2023

According to S&P Global, the top three renewable energy trends for 2023 are declining component costs, localized manufacturing growth, and the rise of distributed energy.

S&P Global indicates that ongoing supply chain disruptions, evolving renewable procurement targets, and the 2022 global energy crisis are shaping a new phase in the energy transition this year.

Cost Dynamics & Bottlenecks

After two years impacted by supply chain constraints, raw material and transportation costs are decreasing in 2023, with global shipping rates returning to pre-pandemic levels. However, S&P Global notes this cost relief won't immediately translate into lower overall capital expenditures for renewable projects.

Land acquisition and grid interconnection remain the industry's most significant bottlenecks. As investors rush to deploy capital in markets with limited grid capacity, they are paying premiums for "shovel-ready" projects, inadvertently driving up development costs. A skilled labor shortage is also increasing construction costs. Combined with rising capital costs, S&P Global states these factors may prevent substantial near-term reductions in project capex.

Module Prices & Market Impact

PV module prices are falling faster than anticipated in early 2023 due to increased polysilicon supply. While this may lower module prices, manufacturers seeking margin recovery could offset the gains. Downstream, installers and distributors are expected to see improved margins, potentially reducing cost savings for rooftop solar end-users. S&P Global highlights that utility-scale project developers will benefit more significantly from lower costs, anticipating intensified global demand, especially in cost-sensitive emerging markets.

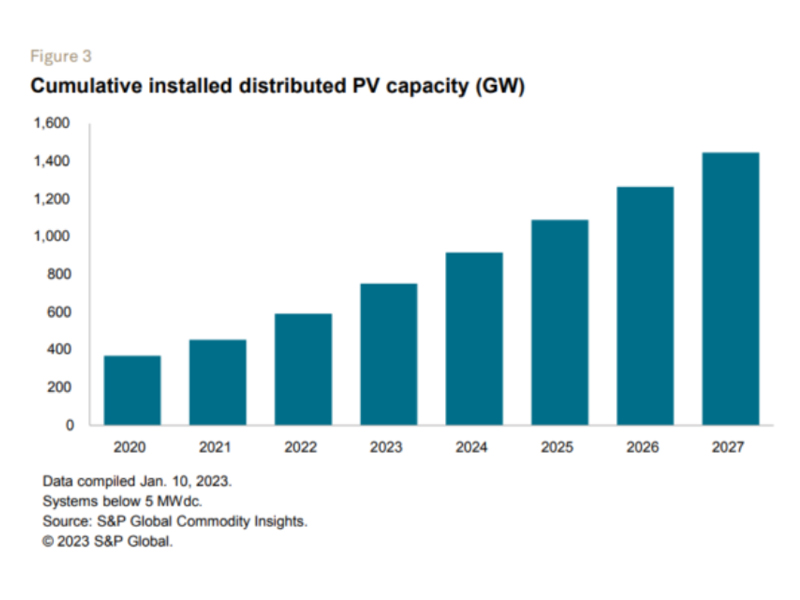

Distributed Solar Expansion

Distributed solar cemented its role as the dominant power supply in many mature markets during 2022. S&P Global expects this technology to expand into new consumer segments and markets in 2023. PV systems will increasingly integrate with energy storage, shared solar options will emerge, and new home/small business projects will gain grid access. Upfront payments remain common for residential projects, though power distributors are promoting diverse financing (long/short leases, PPAs). These models, widely deployed in the US over the past decade, are expected to spread globally. Commercial/industrial customers are also likely to adopt more third-party financing amid liquidity concerns, though S&P Global notes the challenge lies in contracting reputable off-takers.

Policy Support & Manufacturing Shift

The policy environment broadly favors increased distributed generation through cash grants, VAT reductions, rebates, or protective tariffs. Supply chain issues and national security concerns are accelerating localization of solar and storage manufacturing, particularly in the US and Europe, where reducing reliance on imported gas has positioned renewables centrally in energy strategies. Policies like the US Inflation Reduction Act (IRA) and Europe’s REPowerEU are attracting major investment into new manufacturing capacity, which will also boost deployment. S&P Global projects global wind, solar, and battery storage installations will reach nearly 500 GW in 2023, representing a 20%+ increase over 2022.

Persistent Concerns

"Yet concerns persist about China’s dominance in equipment manufacturing – particularly in solar and batteries – and the various risks involved in relying too heavily on a single region to supply the required commodities," S&P Global said.

leave a message

Scan to wechat :