Record Global Expansion Forecast

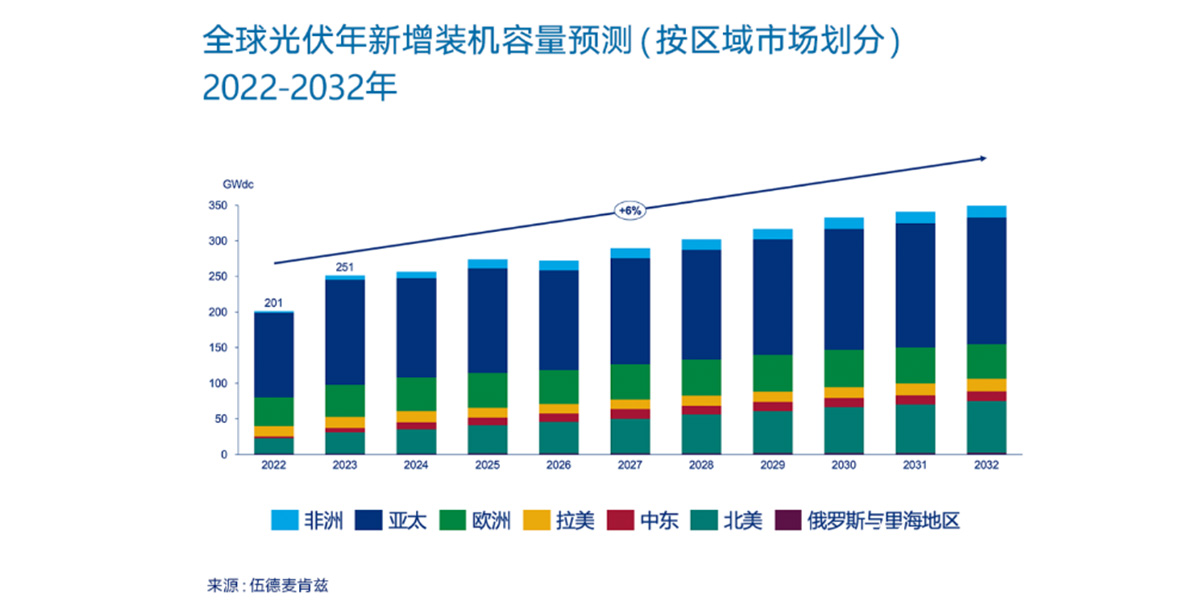

Wood Mackenzie’s global PV research team recently released its Global PV Market Outlook: Q1 2023, projecting record global installations exceeding 250 GWdc in 2023 – a 25% year-over-year increase.

China’s Dominance Solidifies

China will reinforce its global leadership, adding over 110 GWdc of new capacity (40% of global total). During the 14th Five-Year Plan, China’s annual installations will consistently surpass 100 GWdc, marking its entry into the “100 GW era”. Key drivers include:

• Supply chain expansion and falling module prices

• Full grid-connection of first-phase wind-PV bases

• Centralized PV installations expected to exceed 52 GWdc

Distributed PV Challenges Emerge

While nationwide distributed PV promotion policies continue supporting growth, risks exposed in high-capacity provinces (Shandong, Hebei) may slow investment:

• Grid curtailment risks

• Ancillary service costs

These factors could cause 2023 distributed installations to decline.

Global Policy Drivers & Grid Constraints

International growth hinges on regulatory support:

• US Inflation Reduction Act (IRA): $369 billion for clean energy

• EU REPowerEU: 750 GWdc target by 2030

• Germany: Planned tax credits for PV/wind/grid

However, grid bottlenecks threaten mature European markets (notably the Netherlands) as members scale renewables.

Long-Term Outlook & Regional Challenges

Wood Mackenzie projects 6% average annual growth for global PV installations from 2022-2032, with North America surpassing Europe’s annual share by 2028.

In Latin America:

• Chile’s grid delays cause renewable underutilization and suboptimal tariffs

• The National Energy Commission launched transmission tenders and short-term market reforms

• Major markets (e.g., Brazil) face similar infrastructure challenges

leave a message

Scan to wechat :